🧠 Apple’s Quiet Power Moves: Buybacks, Dividends & Long-Term Control

How buybacks and dividends are driving Apple’s value behind the scenes.

Apple isn’t just building the future of hardware—it’s buying back control of its own stock, piece by piece. While headlines focus on foldable iPhones and Vision Pro demos, Wall Street’s eyes are watching something else:

🔒 $100 billion. That’s how much Apple just authorized to spend—on itself.

Here’s what that means, and why it matters to every iPhone owner, investor, or Apple-watcher.

💸 1. What’s a Stock Buyback (And Why Should You Care)?

When Apple buys back its own stock, it reduces the total number of shares in circulation. Fewer shares = each one becomes more valuable. That’s why:

AAPL earnings per share (EPS) goes up

Shareholder value increases (even if profits stay flat)

Apple shows Wall Street it has cash to burn + confidence

Think of it like a pizza: fewer slices, but the same pie. Each share you hold is now a larger slice of Apple.

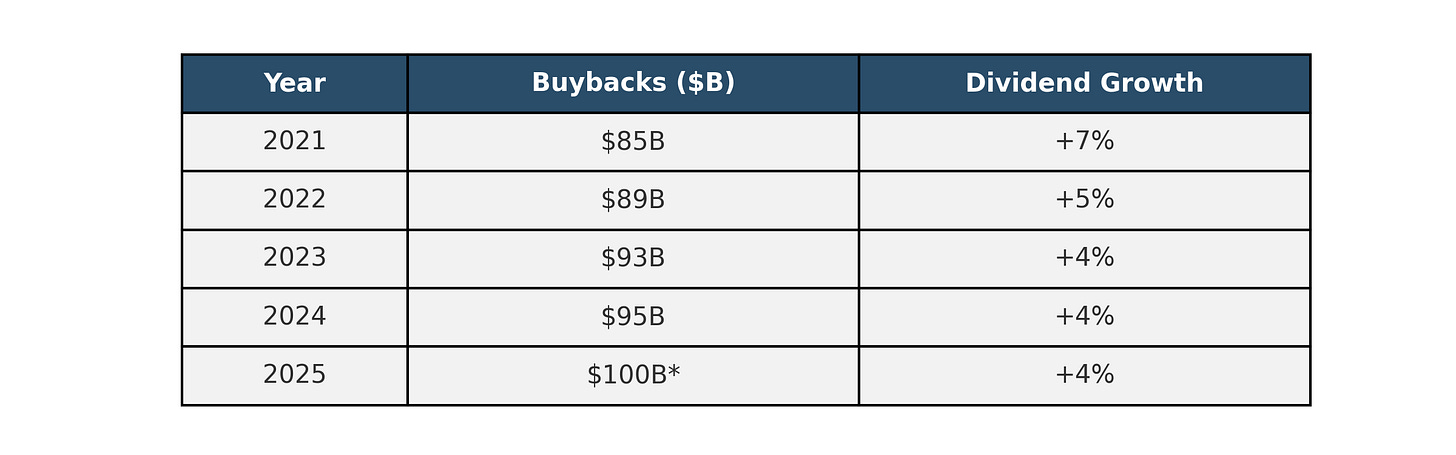

📊 2. What Apple Is Actually Doing (with Charts)

Apple just approved another $100 billion in buybacks for 2025. That’s on top of:

📈 Apple also raised its dividend payout to $0.26/share this quarter—its 12th straight year of dividend increases.

🧠 3. Why Apple Isn’t Buying a Netflix or OpenAI Instead

Here’s the kicker: Apple is choosing buybacks over flashy acquisitions. Why?

Keeps control centralized (no dilution)

Sends a “we’re stable” signal to long-term investors

Gives Apple more leverage with Wall Street without needing outside growth

This is financial control as a feature—a quiet flex in the age of loud tech pivots.

📌 What It Means for You

Whether you hold Apple stock, buy their products, or just follow the tech world:

📉 Don’t be distracted by short-term dips—Apple plays the long game

💰 Buybacks and dividends show Apple is investing in itself

🧠 These moves shape future innovation (and your next iPhone’s price)

💡 Coming next in “Charts”:

“Where Apple Makes Its Money: The $400B Breakdown You’ve Never Seen.”